The real legacy of woke capital gives shape to an outrage style in politics, one that ultimately threatens free markets.

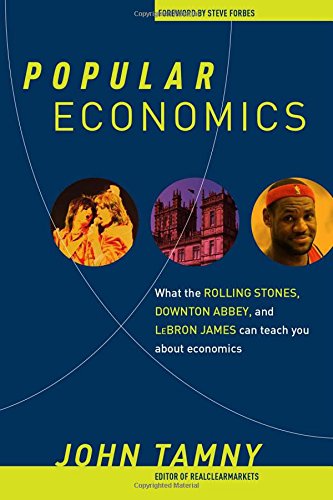

Economics in One Popular Culture Lesson: A Discussion with John Tamny

John Tamny comes to Liberty Law Talk to discuss his excellent new book Popular Economics. Many will recall the first time they read Hazlitt’s Economics in One Lesson. That book’s clear prose and striking examples provided a foundational introduction to free markets. But, as is often true, our practices are better than our theories. We instinctively grasp economics in our daily habits and choices but misunderstand the conditions and principles that support economic growth. Americans are confused about inequality, trade deficits, antitrust policy, fiscal policy, minimum wage, job creation, etc, despite pursuing their own economic self-interest without much thought.

Dispelling such confusion is John Tamny whose work will become the Hazlitt of our day. Using examples from the Rolling Stones to illustrate the folly of taxing capital gains, why common antitrust theories were exposed by the FTC’s blocking of the merger of Blockbuster and Movie Gallery just as Netflix was making both companies obsolete, and demonstrating why the explanations of the 2008 Financial Crisis strain to avoid the obvious factor of currency devaluation, Tamny gives us free market lessons that we can’t not know. Enjoy the interview and buy the book!