The Fed has accumulated operating losses in the billions. It needs to be recapitalized.

The Fed Will Be Forced to Choose: Inflation or Insolvency?

Editor’s Note: This essay is part of a Law & Liberty Symposium on the Future of Debt.

When he chose spending as the focus for his general theory, John Maynard Keynes unintentionally set in motion a sequence of events that have been playing out over the past century. By focusing on spending and then aggregating that spending into what today we call gross domestic product (GDP), Keynes handed politicians a tool that had two uses: economic and political.

The economic use is the less interesting. Keynes defined economic activity as a function of government spending. That he then concluded that increasing government spending increases economic activity is unsurprising.

Keynes’ argument was that the government could smooth, or stabilize, business cycles by increasing government spending during recessions and decreasing government spending during expansions. We call this fiscal policy. Putting aside the fact that effective fiscal policy requires that bureaucrats be able to identify and react to business cycle turning points quickly, Keynes’ argument created two problems.

First, fiscal policy was a siren call to politicians. Keynes’ theory identified government spending as a fiscal policy tool, but politicians used it as a political tool. A politician’s goal is to get elected, and voters prefer politicians who bring more benefits than costs to their districts. Politicians could now promise to spend more government money in their districts and claim that this would be good for the economy. How do they know? Because experts say so. And spend they did. Federal outlays as a fraction of GDP rose from less than 15 percent of the economy after the close of World War II to 20 percent today.

The second problem is that, in treating all spending alike, Keynes’ theory failed to distinguish between production of things that people want and production of things that politicians want. In Keynes’ model, a dollar’s worth of grenades is indistinguishable from a dollar’s worth of guacamole. Consequently, the reality that people might be worse off when taxing and spending replaces consumer goods with government goods shows up nowhere in Keynes’ model.

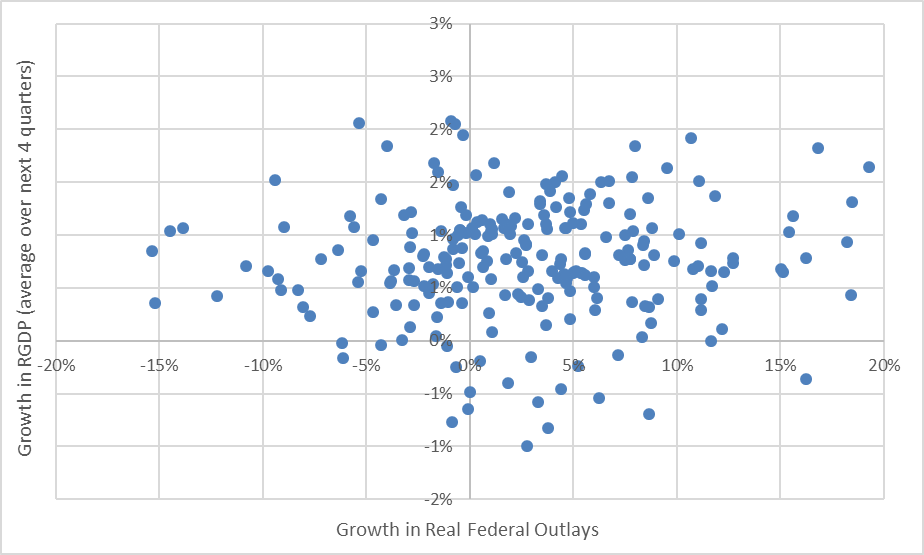

Theory aside, the data do not tell a compelling story for spending as an effective fiscal policy tool. The graph below shows quarterly data from 1959 through 2018. The horizontal axis measures the quarterly growth in inflation-adjusted federal spending. The vertical axis measures the average quarterly growth in inflation-adjusted GDP over the subsequent four quarters. If federal spending were effective in stabilizing the economy, one would expect to see the dots forming an upward sloping pattern, moving from the bottom-left to the top-right of the graph: greater increases in spending would be followed by greater growth.[1] But the data do not show this.

Whether the data are the result of an economic phenomenon (i.e., the failure of Keynes’ theory), or a behavioral phenomenon (i.e., the inability of politicians and bureaucrats to react quickly enough), or a political phenomenon (i.e., a tendency for politicians to raise taxes with spending), or a combination is unclear. What is clear is that, historically, increases in government spending have not been associated with subsequent economic growth.

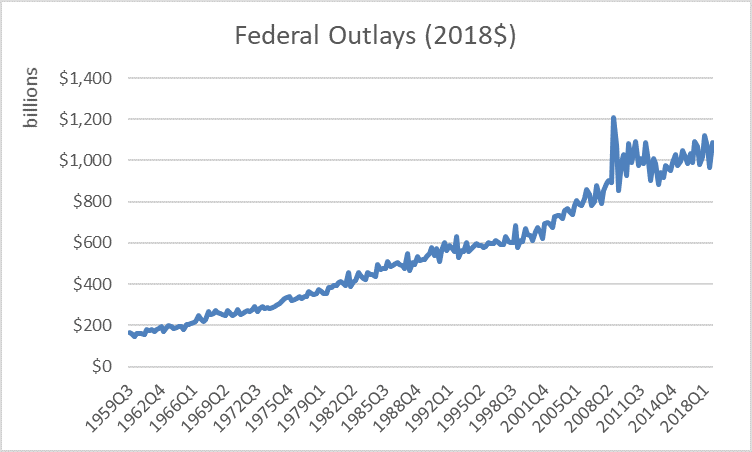

While the data raise questions as to whether spending works as an economic tool, there are fewer questions as to whether it works as a political tool. Even adjusting for inflation, federal outlays today are more than six times what they were in 1959. Voters perceive a benefit to government spending in their districts, and so they elect politicians who deliver that spending.

But spending isn’t costless. While voters find government spending attractive, they find paying for that spending decidedly unattractive. This has given politicians an incentive to find ways to pay for increased government spending without asking the voters to foot the bill. Enter government borrowing.

When the government borrows, it is requiring that future taxpayers pay for today’s spending via on-going interest payments. This method of funding spending has become so popular among both voters and politicians that the official federal debt is now more than six times federal receipts (the federal government’s annual income from all sources combined) – a level last seen at the close of World War II.

And here we see a sequence of events. In the quest for votes, politicians promise voters more government spending. To pay for the spending without raising taxes, politicians direct the government to borrow. As the government borrows more, the annual interest expense on that debt rises.

For the past decade, the Federal Reserve’s monetary policy has held interest rates at historically low levels. Of course, low rates benefit people with mortgages and student loans. But the single largest beneficiary of low interest rates is the federal government. The federal government currently pays around 2.5% interest on its $22.6 trillion debt. That’s more than one-half trillion dollars per year in interest. If the Fed were to allow interest rates to rise merely to their historical average, the interest rate on the government’s debt would rise (though over the course of several years) to around 6%. At that rate, the federal government would owe more than $1.3 trillion per year just in interest.

The unintended consequence of the government having borrowed so much money is to create a link between fiscal policy and monetary policy. The way the Federal Reserve fights inflation or cools an overheating economy is by raising interest rates. But, the larger the federal debt, the greater the chance that raising interest rates will plunge the federal government into fiscal crisis. It is simply a matter of time before the Federal Reserve finds itself having to choose between inflation and federal insolvency.

Sources

Keynes, J.M., 1936. The general theory of employment, interest, and money. Macmillan.

U.S. Bureau of Economic Analysis. FRED database, Federal Reserve Bank of St. Louis.

Office of Management and Budget. Historical tables.

[1] One might argue that not all spending over this period was “stimulus” spending. But “stimulus spending” is a political term, not an economic one. Keynes’ theory does not distinguish between “stimulus spending” and “non-stimulus spending” but applies to all government spending.