Many have mistaken their own outrage for virtue, and then supposed that their virtue absolved them from the necessity to think clearly.

The Destructive Legacy of McCulloch v. Maryland

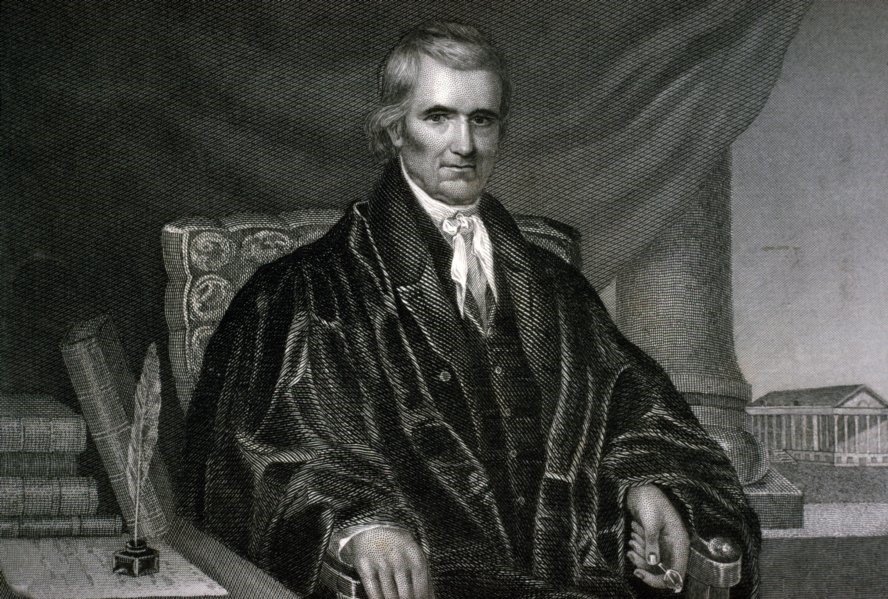

McCulloch v. Maryland (1819) is probably the Supreme Court’s single most influential case. Its importance arises largely from its doctrine of implied congressional powers, which has been applied even to constitutional amendments adopted decades after the McCulloch decision itself. When it was issued, however, Chief Justice Marshall’s opinion produced enough commotion that he was moved to defend it in a series of anonymous and somewhat intemperate newspaper essays. The opinion remained politically controversial for many years, and it deserves to become controversial once again.

The issue in McCulloch was whether the Second Bank of the United States could legally refuse to pay a tax imposed by the state of Maryland on its Baltimore branch. After deciding that Congress had an implied constitutional power to incorporate a bank, the Court held that Maryland’s tax was unconstitutional. Both conclusions were debatable, but the opinion was unanimous. Marshall articulated an elegant and easily defensible legal standard for assessing congressional exercises of implied powers, but his application of that standard was extremely lax. Subsequently, McCulloch was used to justify expanding federal power far beyond its proper constitutional bounds. Although Marshall’s opinion lends itself to this use, the decision need not and should not have been relied on as a precedent for such expansion. McCulloch’s bicentennial is an apt occasion for reevaluating its indisputably significant contribution to American jurisprudence.

Controversy over the First Bank of the United States

The constitutionality of a national bank had been thoroughly debated during the Founding period. When President Washington appointed him Secretary of the Treasury, one of Alexander Hamilton’s first projects was to stabilize the government’s fiscal affairs. As part of that initiative, he offered Congress a detailed proposal for the incorporation of a predominantly private bank in which the federal government would be a minority shareholder. This government-sponsored enterprise would provide banking services to the government, but it would operate like other banks for the profit of its owners.

The Senate passed the bill, apparently without much discussion. The House of Representatives also approved it, by a large margin, but Congressman James Madison led a vigorous opposition. His constitutional objections (as recorded in the House proceedings for February 2, 1791) began with the principle that Congress has only the powers given to it in Article I. Implied powers certainly exist, as the Necessary and Proper Clause confirms, but every one of them must be closely tied to the end and nature of an enumerated power. He argued that once one accepts devices like the proposed bank, which are merely conducive or indirectly related to the exercise of an enumerated power, “a chain may be formed that will reach every object of legislation, every object within the whole compass of political economy.” That would violate the principle that the federal government is one of limited powers, and it would subvert the reserved powers of the states.

Madison also mentioned that the Philadelphia Convention had rejected a proposal to give Congress an enumerated power to grant charters of incorporation. In fact, Madison himself had made that proposal. This suggests that his argument for a narrow reading of implied powers was based on his sincere understanding of the Constitution, rather than on policy-based objections to giving Congress this particular power or on political or policy objections to Hamilton’s bank proposal.

Although his own administration had proposed the bill, President Washington sought opinions about its constitutionality from his Attorney General, Edmund Randolph, and his Secretary of State, Thomas Jefferson. Both of them considered the bill unconstitutional, for reasons similar to Madison’s. Randolph offered a careful analysis that sought to distinguish legal from political or policy analysis, while Jefferson’s was overstated and vulnerable to some powerful rebuttals. Washington then asked his Treasury Secretary to respond.

Hamilton did so on February 23, 1791, arguing that every government has the inherent power to employ those means that have a natural relation to any lawful end. Accordingly, the government may use “all means” that relate to pursuing such ends “to the best and greatest advantage.” But the Constitution does not, for example, authorize Congress to supervise the health, safety, or morals of those who reside in Philadelphia, so a federal corporation may not be established for that purpose. Similarly, said Hamilton, “the constitutional test of a right application [of money] must always be, whether it be for a purpose of general or local nature.”

Skeptics like Madison and Randolph could justifiably wonder whether a distinction between general and local purposes is capable of providing any real security against the slippery slope that so concerned them. But Hamilton made a stronger argument in defense of the bank bill itself. He analyzed in considerable detail the relation between the establishment of a bank and the indisputably legitimate congressional powers over commerce, borrowing, paying the government’s debts, and national defense. The ability to exercise those powers would in many circumstances be extremely constrained without access to banking services, and a law ensuring the availability of those services would not necessarily be a step toward occupying what Madison called “the whole compass of political economy.”

Notwithstanding Hamilton’s thorough defense of his proposal, President Washington apparently remained uneasy. He discussed the issue several times with Congressman Madison, who drafted a veto message at his request. In the end, Washington approved the legislation without comment.

The Constitutionality of the Second Bank

The charter that Washington signed expired by its terms in 1811, and Congress did not pass a bill reestablishing a bank until 1815. By then, Madison was President of the United States. He disapproved the bill, saying in his veto message that he did not think it offered the government sufficient “security for attaining the public objects of the institution.” But he added that constitutional objections were “precluded in my judgment by repeated recognitions under varied circumstances of the validity of such an institution in acts of the legislative, executive, and judicial branches of the Government, accompanied by indications in different modes, of a concurrence of the general will of the nation.”

The next year, Congress passed a bill that satisfied President Madison’s policy concerns, and he signed it. Like its predecessor, the Second Bank of the United States was a federally chartered private bank in which the United States held 20 percent of the stock, and it was authorized to establish branches wherever it chose. The First Bank, created at a time when there were only three state-chartered banks in the whole country, served a pretty obvious government purpose. By 1816, some 242 banks had been established. The Second Bank could threaten their profits and even their viability, which had obvious political implications. Less obviously, the proliferation of state banks affected the constitutional issue because it both lessened the need for a national bank and increased the opportunity for federal interference with state policies. What may have been necessary and proper in 1791 might not have met that criterion in 1816.

McCulloch was not the first case to consider the extent of Congress’ implied powers. In United States v. Fisher (1805), the Court had unanimously upheld a statutory provision requiring that debts to the United States be given priority when distributing the assets of a debtor who became insolvent or bankrupt. Marshall’s opinion in that case had asked what the source of congressional authority for the regulation was, but he ignored the Bankruptcy Clause. Alluding instead to the Necessary and Proper Clause, he offered this analysis:

Congress must possess the choice of means, and must be empowered to use any means which are in fact conducive to the exercise of a power granted by the constitution. The government is to pay the debt of the union, and must be authorized to use the means which appear to itself most eligible to effect that object.

Any means at all, no matter how unnecessary or improper they might look to a disinterested judge? Fisher’s formulation looks like a carte blanche exempting Congress from any meaningful judicial scrutiny. And if there was a good reason not to rely on the narrower Bankruptcy Clause, Marshall did not say what it was.

Fisher is not mentioned in McCulloch, which proceeds more judiciously. The opinion includes an acknowledgment that the principle of limited and enumerated powers “is now universally admitted,” as well as two specific arguments for upholding the Bank. First, the constitutionality of a national bank, “if not put at rest by the [long] practice of the government, ought to receive a considerable impression from that practice.” Only a “bold and plain usurpation,” Marshall suggests, would justify the Court in repudiating an established exercise of congressional power. Second, even without such an established practice, both the dictates of reason and the Necessary and Proper Clause authorize Congress to choose appropriate means of executing the powers given to it.

Marshall explains this second conclusion in what became a celebrated legal test:

Let the end be legitimate, let it be within the scope of the Constitution, and all means which are appropriate, which are plainly adapted to that end, which are not prohibited, but consist with the letter and spirit of the constitution, are constitutional.

Although McCulloch contains some other language that resembles the parallel passage in Fisher, this formulation is carefully calibrated to respect both the federal government’s legitimate needs and the limited scope of federal power. Marshall, moreover, adds a promise that the Court will stop Congress from invoking its lawful powers as a pretext for accomplishing objects not entrusted to it.

Even Madison or Randolph might have been persuaded to accept this general rule from McCulloch. But how does one determine which means are appropriate and which are inconsistent with the spirit of the Constitution? How plainly must a means be adapted to a legitimate end? And how should a court investigate the possibility that the exercise of a granted power is a pretext for usurpation? Depending on how such questions are answered in specific cases, the apparent difference between Fisher and McCulloch could easily evaporate.

Unfortunately, McCulloch does little more than gesture vaguely at the contribution a bank can make to the exercise of Congress’s enumerated powers. This contrasts with the detailed exposition in Hamilton’s opinion. When you add the fact that the banking sector of the economy was far more developed in 1816 than it had been in 1791, Marshall could be seen as suggesting, in the spirit of Fisher, that the Court should rubber-stamp congressional exercises of power whenever there has not been a plain and bold usurpation.

This suggestion is strengthened by some obvious reasons for doubting that this particular bank law was consistent with the spirit of the Constitution. The McCulloch opinion never mentions that Congress had not established a government agency, but instead had incorporated an essentially private bank controlled by private shareholders who sought profits for themselves. That institution, moreover, was given competitive advantages over banks chartered by the states.

Shouldn’t the lawyers for the Second Bank at least have been required to justify these features of the law, perhaps with evidence that the government’s ability to carry out its legitimate functions was seriously threatened by deficiencies in the existing banks? And how did the Court know that the Second Bank was structured so as to serve the government’s interests rather than as a pretext to enrich the private shareholders? For example, did the Bank’s license to establish branches anywhere it chose serve any real purpose other than increasing private profits?

Such questions were raised by Maryland’s lawyers. Marshall ignored those questions, while expatiating without any clear necessity on the political theory of the Union. He plausibly rejected conclusions that could have crippled the federal government, but he did not address serious issues raised by the specific statute before the Court. Had he provided a reasoned analysis of the problematic aspects of the statute, it would be harder to interpret McCulloch as a slightly disguised reaffirmation of Fisher’s blatant invitation to congressional overreaching. Unfortunately, the opinion’s airy silence in the face of these problems has made it easy to treat McCulloch as just such an invitation.

The Constitutionality of Maryland’s Tax

McCulloch’s analysis of Maryland’s tax is even weaker than its truncated discussion of the Bank. Much of it is devoted to refuting the proposition that the states have an absolute and unfettered constitutional right to tax the federal government. Marshall rightly refused to adopt a doctrine whose logic would leave the nation’s fisc at the mercy of hostile or irresponsible state governments. It does not follow, however, that Maryland’s tax on the Baltimore branch of the Bank was prohibited.

Some passages in McCulloch suggest, without a supporting argument, that any state tax on a federal instrumentality is inherently unconstitutional, presumably even if authorized by Congress. More likely, Marshall meant that the statute establishing the Bank forbade the states to tax it. But the statute doesn’t address the question one way or the other. Moreover, the tax was not very onerous, and was apparently comparable to a tax that Maryland imposed on state-chartered banks. If asked, Congress might have decided to ban a tax like Maryland’s, or it might have expressly acquiesced in such a tax. But Congress was not asked and did not answer. To confuse things further, the Court drew an unexplained distinction between a forbidden tax on the operations of the Bank, on one hand, and permissible taxes on the real property of the Baltimore branch or the financial interest Marylanders might have in the Bank, on the other.

Under either interpretation of Marshall’s meaning, the Court unconstitutionally usurped a congressional prerogative. The notion of inherent unconstitutionality has no basis in the constitutional text, and it is absurd to suppose that the federal government may not allow its instrumentalities to be taxed by the states. Under the more plausible reading of McCulloch, the Court imputed to the statute what is now called “obstacle preemption”; this interpretive technique enforces policies that the justices like to imagine the legislature would enact if asked, but which it has not enacted. Obstacle preemption has since become a standard routine in the activist repertoire of the modern Court.

President Jackson on the Authority of McCulloch

In 1832, Andrew Jackson issued an elaborate veto message when presented with a bill to recharter the Second Bank before its term expired. Like Madison, he acknowledged that a sufficiently clear and durable national consensus could settle debatable constitutional questions. But the bank precedents established by past practice were mixed, and controversies over the issue had persisted. Nor did McCulloch settle the matter. In Jackson’s view, the Court has no authority to control the President in the exercise of his legislative powers. In any event, he maintained, McCulloch had merely decided in general terms that incorporating a bank is permissible, leaving the political branches to exercise their own constitutional judgment on particular legislative proposals.

Jackson provided a detailed analysis of many unconstitutional features that he perceived, rightly or wrongly, in this particular bank’s structure. He agreed that a bank could constitutionally be established, and he offered to propose a way to do it. But he rightly refused to conflate a judicial decision, or majority sentiment in Congress, with what Madison called “the general will of the nation.”

In McCulloch, Marshall accurately predicted that “the question respecting the extent of the powers actually granted [by the Constitution], is perpetually arising, and will probably continue to arise, as long as our system of government shall exist.” Andrew Jackson understood that a mere Supreme Court opinion is not a good reason to treat that question as closed. Unfortunately, his sense of responsibility to the Constitution went very much out of fashion. Too many Presidents and too many legislators came to believe that the Constitution allows Congress to do anything that a very indulgent Supreme Court will countenance.

McCulloch’s Destructive Legacy

The Court very rarely rules that Congress has exceeded its powers except when it violates an individual right that the justices have selected for enforcement from the Constitution, or have creatively imputed to it. From the New Deal through the mid-1990s, the justices signaled that the Commerce Clause gives Congress authority to regulate everything in human life that is not protected by one of these judicially favored individual rights. From the mid-1990s to the present, the Court has recognized a handful of trivial or symbolic exceptions, but Congress can easily evade these supposed restrictions, either through minimally competent legislative draftsmanship or by regulating our lives indirectly through taxation and spending.

It was neither necessary nor proper for McCulloch to assume without analysis that all the features of the Second Bank were both necessary and proper. Nor was it necessary or proper for later Courts to adopt a Fisheresque level of deference as the standard for judging the boundaries of congressional power. Like Marshall, the justices of the current Court can say that the abstract principle of limited and enumerated powers is “now universally admitted.” But the legacy of Marshall’s decision has been the effective destruction of that principle.

McCulloch famously proclaimed that “we must never forget, that it is a constitution we are expounding.” This sonorous aphorism is frequently, if unnecessarily and improperly, taken to mean that it is merely a constitution, which judges are free (or obligated!) to amend under the guise of interpretation. That attitude has triumphed historically, and perhaps irrevocably. But we could choose to stop forgetting that the Constitution is more authoritative than what the Supreme Court has said about it. If we did, McCulloch and its progeny would become controversial once again.