The Washington Post reports that federal-state plans for a high-speed train connecting San Francisco with Los Angles and points in-between may never come off the ground. In the face of public resistance, the state may have to decline some $3.5 billion in federal “stimulus” funds dedicated to an initial segment of the line, connecting the thriving metropolises of Bakersfield and Merced. We may be witnessing an outbreak of fiscal and institutional sanity. Keep reading to learn more.

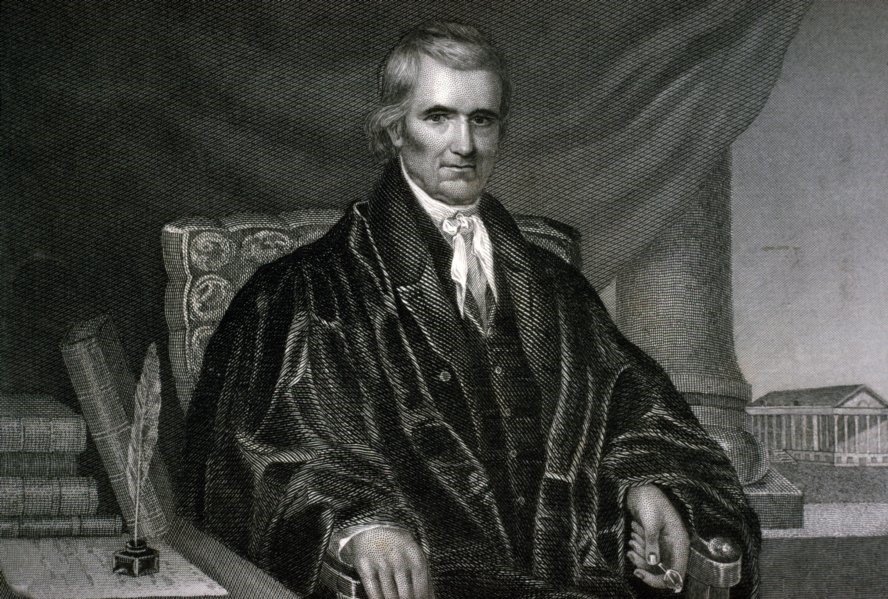

Would that John Marshall’s Great Opinion Were Cited Oftener Today

Nelson Lund’s analysis of McCulloch v. Maryland (1819) is a challenging one for admirers of the Great Chief Justice—among whom I count myself. In what follows, I shall reply to those elements of his Liberty Forum essay with which I take issue.

Let us consider, first of all, James Madison’s argument in the U.S. House of Representatives that (in Lund’s words) “the Philadelphia Convention had rejected a proposal to give Congress an enumerated power to grant charters of incorporation.” Secretary of State Thomas Jefferson mentioned this fact as well, in his opinion for President Washington on the Bank bill.

But reliance on this vote by the Convention not to enumerate an incorporation power is a species of “original intent” analysis, contrary to the sound doctrines of textualism and original meaning jurisprudence. Treasury Secretary Hamilton, in his 1791 opinion for Washington, notes just how equivocal was the record of the event at Philadelphia in 1787, and how little can be reliably inferred from it with respect even to the intention of the whole body of the Convention—let alone with respect to the interpretation we should give to the Constitution’s text as it finally emerged from Independence Hall. Marshall, in his McCulloch opinion, wisely does not mention this vote of the Convention at all, instead inferring from the absence of such an enumerated power that, “considered merely as a means” to other ends, “there could be no motive for particularly mentioning it” in the Constitution.

Next, Lund sets United States v. Fisher (1805) in contrast with McCulloch v. Maryland, but it is difficult to say to what purpose he does so. In one breath, he characterizes Fisher as granting a “carte blanche exempting Congress from any meaningful scrutiny” whereas McCulloch “proceeds more judiciously.” A little while later he reads McCulloch “in the spirit of Fisher,” which he characterizes as a “blatant invitation to congressional overreaching.” This appears to be Lund’s last word, assimilating McCulloch to Fisher.

For my part, I am quite content to read Fisher and McCulloch as fundamentally similar in reasoning—and to make the case that neither opinion is objectionable in the least.

An Anachronistic View of Marshall

The chief difficulty with Lund’s understanding of both cases is that it appears to be founded on an anachronistic conception of the scope of the judicial power—or at least one very far from the perspective of Marshall and his generation. His central complaint about Marshall’s treatment of the Bank’s constitutionality in McCulloch, for instance, is that the chief justice “does little more than gesture vaguely at the contribution a bank can make to the exercise of Congress’s enumerated powers. This contrasts with the detailed exposition in Hamilton’s opinion.” McCulloch would be a more satisfactory ruling, in Lund’s view, if it restated all the arguments that legislators and executives would consider as bearing on the bank’s practical utility.

But the contrast with Hamilton that Lund offers is one that Marshall understood perfectly. In the fifth and final volume of the first edition of his Life of George Washington (1807), Marshall had included several extensive notes in an appendix, with pointers to those notes in the text. At the place in the text where he wraps up his account of the 1791 enactment of the Bank bill, he points to one such note, in which he freely paraphrases the arguments offered by Jefferson, Randolph, and (above all) Hamilton for Washington’s consideration on the constitutionality of the act.

The note devotes about six of its eight pages to recapitulating the Treasury secretary’s essential arguments in favor of ample legislative discretion under the Necessary and Proper Clause. What Marshall leaves out is all of the “detailed exposition” of the Bank’s usefulness that one finds in Hamilton’s opinion. The reason Marshall gives for this omission is his final word in the note: “To detail those arguments would occupy too much space, and is the less necessary, because their correctness obviously depends on the correctness of the principles which have been already stated.” (Emphasis added.) In short, it suffices to show that the incorporation of a bank is legitimately within the range of legislative choice, as a proper means to the end of various enumerated powers. How exactly the Bank effectuates those ends in the most useful way is not a question of first principle, constitutionally speaking.

Marshall’s Fisher opinion, written two years before his Life of Washington, is in keeping with this understanding. Lund himself quotes the essential point from Fisher: “The government is to pay the debt of the union, and must be authorised to use the means which appear to itself most eligible to effect that object.” (Emphasis added.) In other words, choosing within the permissible scope of its power, Congress acts on its own constitutional judgment as an interpreter of the text, free of second-guessing by judges.

Just so, in McCulloch, Marshall explicitly rejected the idea that a fine-grained analysis of the Bank’s utility was a fitting task for the judiciary: “the degree of its necessity . . . is to be discussed in another place”—that is, in Congress and the executive cabinet. Indeed, “to undertake here to inquire into the degree of its necessity would be to pass the line which circumscribes the judicial department and to tread on legislative ground. This Court disclaims all pretensions to such a power.”

He Correctly Grasped the Separation of Powers

Unlike our latter-day advocates of judicial engagement, Marshall had a proper sense that the separation of powers embodied principled limitations on the scope of judicial power. He likewise understood that responsibility for interpreting the scope of legislative power rests first and most heavily on the Congress itself, next on the Presidents who must discern their constitutional duty when bills reach their desk, and last of all—and most lightly—on the judiciary.

As Marshall was to observe months later, in the pseudonymous newspaper essays that Lund characterizes as “somewhat intemperate,” the critics of the Court’s decision would not be content with anything less than a judicial showing, in detail, that a means Congress has chosen as “necessary and proper” for serving the ends of its enumerated powers is so absolutely necessary that the end can be accomplished in no other way. But this was an absurdity, as the chief justice (writing as “A Friend to the Union”) explained:

In almost every conceivable case, there is more than one mode of accomplishing the end. Which, or is either, indispensable to that end? Congress, for example, may raise armies; but we are told they can execute this power only by those means which are indispensably necessary; those without which the army could not be raised. Is a bounty proposed? Congress must inquire whether a bounty be absolutely necessary? Whether it be possible to raise an army without it? If it be possible, the bounty, on this theory, is unconstitutional.

Professor Lund, to his credit, does not adopt the self-refuting argument Marshall describes here. Yet his argument is its close cousin, demanding that judges recapitulate the work of Congress, turning the details of a bill’s efficacy this way and that, and potentially deciding that if some other way of effectuating constitutional ends is available—a way that judges might think preferable for analytical reasons of their own—then they should declare an act of Congress unconstitutional. In Marshall’s view, such an assignment to the Court was an invitation to judicial supremacy, and for that reason he rejected it.

The Power to Tax Is the Power to Destroy

I differ with Professor Lund as well respecting the second question in McCulloch, as to the power of Maryland to tax the operations of the Bank. He complains that “the Court drew an unexplained distinction between a forbidden tax on the operations of the Bank, on one hand, and permissible taxes on the real property of the Baltimore branch or the financial interest Marylanders might have in the Bank, on the other.” But the distinction is not unexplained. Marshall describes each of the permissible taxes as affecting Bank property or interest income “in common with” all similarly situated real property or income “of the same description throughout the State.” The Maryland legislature could be counted on not to be so crazy that it would tax all real estate in the state onerously enough to harm the Bank, because it would likewise harm all other property owners. Ditto for any tax on bank-interest income, if it uniformly affected interest paid by all banks alike.

The tax at issue in McCulloch, by contrast, was (as the title of the act put it) on “all Banks or Branches thereof in the State of Maryland not chartered by the Legislature,” and imposed a requirement that all banknotes be issued on officially stamped paper, ranging (as Mark R. Killenbeck says in his book on the case) “from 10 cents to $20, depending on the value of the note.” Killenbeck adds that any “bank wishing to avoid the tax could do so by paying an annual fee of $15,000,” which was a considerable amount in the 1810s. (Pace Professor Lund, I know of no basis for the claim that this “was apparently comparable to a tax that Maryland imposed on state-chartered banks.”)

As Killenbeck also points out, Maryland was not alone in its attempt to use the power to tax to attack the Bank. Tennessee taxed any bank not chartered by the state $50,000 per annum. Ohio levied a $50,000 tax per branch of the bank, and Kentucky an annual tax of $60,000 per branch.

Marshall wasn’t entertaining mere hypotheticals when he remarked that the power to tax is the power to destroy. And the Bank, though a private corporation for many purposes, was undeniably an instrument of federal policy. As Marshall observed:

If the States may tax one instrument, employed by the Government in the execution of its powers, they may tax any and every other instrument. They may tax the mail; they may tax the mint; they may tax patent rights; they may tax the papers of the custom house; they may tax judicial process; they may tax all the means employed by the Government to an excess which would defeat all the ends of Government.

According to Professor Lund, “McCulloch’s analysis of Maryland’s tax is even weaker than its truncated discussion of the Bank.” On the contrary, whatever one thinks of Marshall’s opinion on the constitutionality of the Bank, his opinion on Maryland’s claim of a power to tax the Bank is airtight. Indeed, in the pseudonymous newspaper attacks by “Amphictyon” and “Hampden” on the Court’s ruling to which Marshall responded, practically nothing is said on this aspect of the case. All of the critics’ fire is directed at the constitutionality of the Bank, and at the account of the nature of the Union espoused in Marshall’s opinion (an account he offered, as he explained in the opinion, only in order to rebut the cockeyed theories of Maryland’s counsel).

If the Bank was constitutional, the impermissibility of the tax followed axiomatically from the supremacy clause, and the critics knew it. It is no accident that this second part of Marshall’s opinion was half the length of the first.

Space does not permit me to comment on Professor Lund’s assessment of McCulloch’s legacy for the scope of federal power in our own time. I will only say here that I do not see Marshall’s great opinion cited enough by modern judges, not least for its understanding of the proper—and necessary—limits of the judicial power.